The UK rules on intestacy explained (with flowchart)

The rules of intestacy can get quite complicated. Understand them at a glance with our simple flowchart and guide.

When a person dies, they leave behind an estate. This is the total value of the person's money, property and possessions.

This estate must be shared among beneficiaries (people who are allowed to inherit). However, the question of who gets what can be complicated.

It's simplest if the person who died left a will. Their will should list beneficiaries and explain what each is entitled to. It should also name an executor – the person responsible for dealing with the estate.

However, if there was no will, then the rules on intestacy apply. These are a series of checks to determine who should inherit the estate and how much they should get.

What are the rules on intestacy (laws of intestacy)?

With a will, a person controls what happens to their money, property and possessions when they die. They can decide to give half to their spouse and half to their children, for example. Or they can give their entire estate to a third party or a charity.

If they don't leave a will, however, they can't decide who gets what. Instead, there's a set of rules that decide who the beneficiaries are. These are called the 'rules of intestacy' (or 'laws of intestacy').

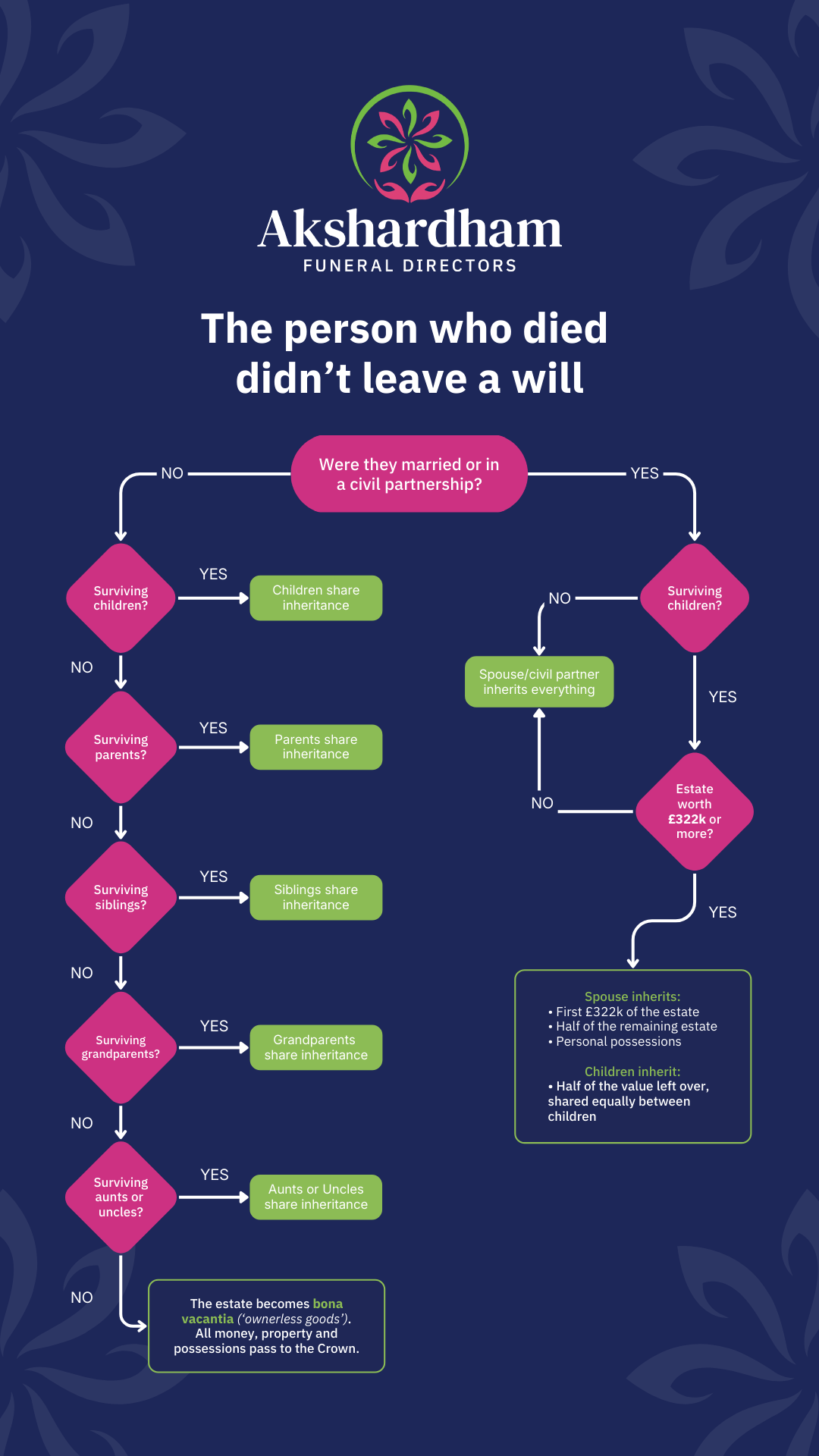

The rules can get quite complicated. However, the basics of intestacy can be broken down as a series of 'yes' and 'no' questions. When you look at the rules like this, they might start making a little more sense.

That's why we've created a simple rules of intestacy chart. If you're going through an inheritance process and there's no will, this should help you figure out who the beneficiaries should be. We also explain the rules in a little more detail below.

Please note that this guide applies to intestacy rules in England and Wales. The rules of intestacy in Scotland and Northern Ireland are a little different. You can learn more at gov.scot (Scotland) or nidirect (Northern Ireland).

Rules on intestacy flowchart

The rules of intestacy chart explained

Who inherits if the person was married or in a civil partnership?

That depends on two things:

- Whether the person who died had surviving children

- The value of the person's estate

If the person had no surviving children, their spouse or civil partner inherits all of the estate.

If the person had children and those children are still alive, they may be entitled to some of the estate. It depends on how much the estate was worth. This is calculated by adding up the value of all the person's money, property and possessions, then subtracting any debts the person owed.

The spouse or civil partner still inherits everything if the estate's total value is less than £322,000.

However, if the estate is worth

more than £322,000, then the estate is shared between the spouse/civil partner and the person's children.

In this case, the spouse or civil partner inherits:

- All the person's possessions

- The first £322,000 of the estate

- Half of the remaining value of the estate

The children inherit whatever's left over, sharing their portion of the estate among themselves.

An example

Harry passes away, leaving an estate worth £500,000. He doesn't leave a will.

Harry has three children from a previous marriage. When he died, he was married to his second wife Tatiana.

Under the rules of intestacy, Tatiana is entitled to all of Harry's possessions, the first £322,000 of his estate and half of what's left. This adds up to £411,000.

That leaves £89,000 for Harry's children. Since he has three children, they each inherit a third of this remaining estate. That's about £29,600 per child.

What happens if the person's spouse or civil partner is no longer alive?

If the person who died outlived their spouse or civil partner, then the inheritance passes to the next beneficiary under the laws of intestacy.

That's often the person's children. If there are no children, it could be the person's parents, siblings or another, more distant relative. We cover these rules in more detail below.

Can a partner inherit if they were not married to the person who died?

No. If the person was not married or in a civil partnership with their partner, then the partner won't inherit any of the estate. This is true even for long-term and cohabiting partners.

Who inherits if the person was NOT married or in a civil partnership?

If the person was not married or in a civil partnership, the estate passes to another living relative. The laws of intestacy decide who is entitled to inherit first.

It all depends on what relatives the person had and whether those relatives are still alive. First, the estate goes to the person's children. If they had no surviving children, it passes to their parents, then their siblings, and so on.

Here's how the checks work:

- If the person who died had surviving children, those children share all of the person's estate.

- If there are no surviving children, the estate passes to the person's parents.

- If the person's parents have died, the estate is shared among the person's brothers and sisters.

- If the person had no surviving siblings, the estate is shared among half-brothers and half-sisters.

- If there are no surviving half-siblings, the estate passes to the person's grandparents.

- If the person's grandparents have died, the estate passes to any surviving aunts and uncles.

- If there are no aunts or uncles,

the checks stop. The estate is considered ownerless and passes to the Crown (the British state).

Can stepchildren inherit the person's estate?

No. Under the UK rules on intestacy, stepchildren generally can't inherit.

The same goes for step-siblings. Half-siblings can inherit if there's no surviving spouse, children, parents or full siblings. However, step-siblings can't.

Can adopted children inherit?

Yes. If a person is legally adopted, they have the same right to inherit as if they were born into their adoptive family. However, the adopted person has no right to inherit anything from their birth family's estates.

Who inherits if there are no surviving relatives?

The rules of intestacy go as far as the person's aunts and uncles. The checks don't consider any relatives more distant than this.

If there's no surviving spouse, children, parents, grandparents or aunts and uncles, the estate is considered bona vacantia. This is Latin for 'ownerless property'.

If this happens, the estate passes to the British state (the Crown). The Crown will hang onto ownerless estates for 30 years. After 30 years, the Crown legally owns the estate.

If you believe you're entitled to a share of a bona vacantia estate, you can make a claim on the GOV.UK website.

Akshardham Funeral Directors is an independent funeral home in Edgware, North London. For more advice, follow our blog or read our funeral planning guides.